TREBB RELEASES MAY STATS

The

Greater Toronto Area (GTA) housing market experienced an improvement in

affordability in May 2025 relative to the same period a year earlier. With

sales down and listings up, homebuyers took advantage of increased inventory

and negotiating power.

“Looking

at the GTA as a whole, homebuyers have certainly benefited from greater choice

and improved affordability this year. However, each neighbourhood and market

segment have their own nuances. Buyers considering a home purchase should

connect with a REALTOR® who is knowledgeable about their preferred area and

property type. In today’s market, working with a REALTOR® who brings expertise,

the right tools, and a strong network is essential,” said Toronto Regional Real

Estate Board President Elechia Barry-Sproule.

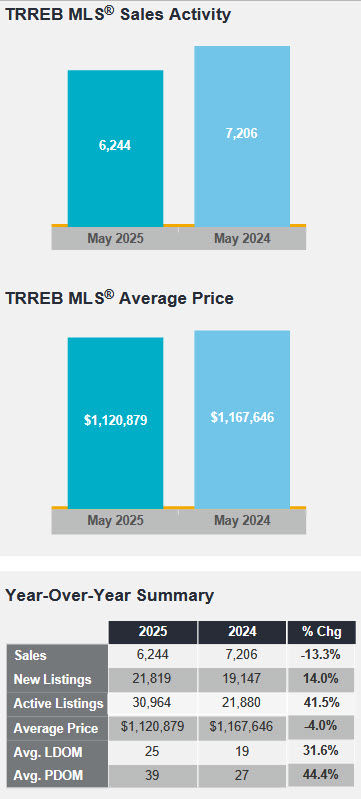

GTA

REALTORS® reported 6,244 home sales through TRREB’s MLS® System in May 2025 –

down by 13.3 per cent compared to May 2024. New listings entered into the MLS®

System amounted to 21,819 – up by 14 per cent year-overyear.

On

a seasonally adjusted basis, May home sales were up month-over-month compared

to April 2025. This was the second monthly increase in a row. New listings were

also up compared to April, but by a lesser monthly rate than sales, suggesting

a slight tightening in market conditions.

“Home

ownership costs are more affordable this year compared to last. Average selling

prices are lower, and so too are borrowing costs. All else being equal, sales

should be up relative to 2024. The issue is a lack of economic confidence. Once

households are convinced that trade stability with the United States will be

established and/or real options to mitigate our reliance on the United States

exist, home sales will pick up. Further cuts in borrowing costs would also be

welcome news to homebuyers,” said Jason Mercer, TRREB’s Chief Information

Officer.

The

MLS® Home Price Index Composite benchmark was down by 4.5 per cent

year-over-year in May 2025. The average selling price, at $1,120,879, was down

by four per cent compared to May 2024. On a month-over-month seasonally

adjusted basis, the MLS® HPI Composite and average selling price both edged up

compared to April 2025.

“With

the federal government’s housing commitments reiterated in the Throne Speech,

we now need concrete actions that will restore housing affordability across the

GTA and the rest of Canada. This includes lowering high housing taxes and fees,

embracing innovative construction technologies, and streamlining processes to

reignite the construction of homes. Home construction is associated with huge

economic benefits that would help mitigate the negative impact of ongoing trade

disputes. Additionally, with inflation remaining low, a rate cut would be a

welcome move—particularly for first-time buyers and those renewing their

mortgages”, said TRREB CEO John DiMichele.

What's next?

P.S. Download our FREE Home Buyer's Guide OR our FREE Home Seller's Guide

P.S.S. Book a FREE Home Buyer Consultation OR a FREE Home Seller Consultation